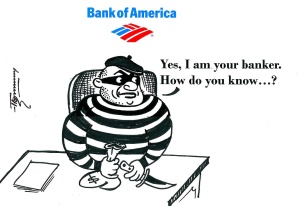

2– BACK ON 10/24/12, BANK OF AMERICA WAS SUED BY THE FEDS FOR

OVER $1 BILLION IN A MULTI-YEAR MORTGAGE FRAUD. MUCH OF THE CASE IS BASED ON THE BANK’S FINANCIALLY DISASTROUS PURCHASE IN 2008 OF ITS FORMER COUNTRYWIDE UNIT WHICH ALLEGEDLY CREATED A MORTGAGE SCHEME, CALLED THE “HUSTLE”, TO RESELL THOUSANDS OF FRAUDULENT AND DEFECTIVE MORTGAGES TO THE FEDERALLY OWNED FANNIE MAE AND FREDDIE MAC.

THE GOVERNMENT SAID THOSE QUESTIONABLE MANEUVERS COST TAXPAYERS ABOUT A BILLION DOLLARS WHICH THE FEDS WANT TO RECOVER.

IN A THREE -YEAR PERIOD ENDING IN 2007, COUNTRYWIDE ORIGINATED $1.3 TRILLION IN LOANS. BANK OF AMERICA’S PURCHASE OF COUNTRYWIDE HAS COST THE BANK AN ESTIMATED $40 BILLION IN REAL-ESTATE LOSSES, LEGAL EXPENSES AND SETTLEMENTS WITH STATE AND FEDERAL AGENCIES, ACCORDING TO THE WALL STREET JOURNAL.

SO WHAT’S NEW? WELL IN APRIL, THE BANK AGREED TO PAY $165 MILLION TO SETTLE ACCUSATIONS FROM THE FEDS THAT THE BANK

SOLD MORTGAGE –BACK SECURITIES TO CORPORATE CREDIT UNIONS THAT LED MANY OF THEM TO FAIL. THE CHARGES WERE BROUGHT BY THE NATIONAL CREDIT UNION ADMINISTRATION.

BUT THE BLEEDING FROM THOSE TAINTED MORTGAGES CONTINUES. IN RECENT MONTHS, THE BANK HAS SETTLED $14 BILLION IN MORTGAGE-RELATED CLAIMS. THE BREAKDOWN:

$3 BILLION TO END LOAN-BY-LOAN REVIEWS REQUIRED BY THE GOVERNMENT.

$11.6 BILLION TO RESOLVE ACCUSATIONS FROM FANNIE MAE ABOUT IMPROPERLY SOLD MORTGAGES THAT FAILED, AND TO RESOLVE QUESTIONS ABOUT FORECLOSURE DELAYS,

$8.5 BILLION THAT THE BANK IS IN THE PROCESS TO RESOLVE CLAIMS FROM PRIVATE INVESTORS WHO BOUGHT THE SHAKY SECURITIES, ACCORDING TO THE NEW YORK TIMES. UNNECESSARY TO REPORT, THE BANK DID NOT ADMIT WRONGDOING.

I WONDER ABOUT THE REACTIONS FROM B OF A CUSTOMERS IF THEY SAW A NEW SLOGAN OVER THE BANK DOORS: “BILLIONS PAID BUT NO WRONGDOING.”

2—BANKSTER RAP SHEET UPDATE: HSBC PAID ALMOST $ 2 BILLION BUT CITIGROUP JUST HAS TO IMPROVE CONTROLS OF TAINTED MONEY BUSINESS

IN A PREVIOUS REPORT HERE ON THE MULTI ACCUSATIONS AGAINST THE HONG KONG AND SHANGHAI BANKING CORPORATION , THE BANK HAD AGREED TO A RECORD SETTLEMENT OF $1.92 BILLION WITH THE FEDS TO SETTLE CHARGES OF TRANSFERS OF BILLIONS OF DOLLARS FOR NATIONS LIKE IRAN AND ENABLED MEXICAN DRUG CARTELS TO MOVE MONEY ILEGALLY THROUGH ITS AMERICAN SUBSIDIAIRIES. THAT WAS ONLY LAST DECEMBER.

AT THE END OF MARCH THIS YEAR, THE FEDERAL RESERVE SERVED CITIGROUP WITH A TEPID “ENFORCEMENT ACTION” OVER BREAKDOWNS IN MONEY LAUNDERING CONTROLS THAT ALSO INVOLVED THE BANK’S MEXICAN SUBSIDIARY.

THE FED SAID THE U.S. BANK AND BANAMEX USA FAILED TO MONITOR CASH TRANSACTIONS OF POTENTIALLY SUSPICIOUS ACTIVITY, ACCORDING TO THE NEW YORK TIMES OF MARCH 27.

THE BANK SECRECY ACT REQUIRES FINANCIAL INSTITUTIONS, LIKE BANKS AND CHECK-CASHING BUSINESS, TO REPORT CASH TRANSACTIONS OF MORE THAN $10,000 AND ALERT REGULATORS TO ANY DUBIOUS OR EXTRAORDINARY ACTIVITY.

BANKS ARE REQUIRED TO HAVE EXTENSIVE AND COMPLEX CONTROLS TO MONITOR CRIMINAL ACTIVITY WHICH, REGULATORS HAVE LONG ARGUED, ALLOW DRUG DEALERS AND TERRORISTS TO LAUNDER MONEY THROUGH AMERICAN BANKS.

THE ENFORCEMENT ACTION REQUIRES THE BANK’S BOARD TO PRESENT A PLAN TO STRENGTHEN TRANSACTION MONITORING AND HAVE A COMPLIANCE RISK PROFILE AIMED AT STOPPING ILLEGAL MONEY TRANSFERS.

THE BANK IS ALREADY UNDER A CEASE-AND-DESIST ORDER THAT THE OFFICE OF THE COMPTROLLER OF THE CURRENCY (OCC) ISSUED LAST APRIL. THAT FEDERAL REGULATOR IS THE BANK’S PRIMARY GOVERNMENT OVERSEER.

IN THAT ORDER, THE GOVERNMENT DEMANDED THE BANK TO IMPROVE ITS MONEY-LAUNDERING CONTROLS AND ACCUSED CITIGROUP OF VIOLATING THE BANK SECRECY ACT.

SO WHY HAS MORE THAN A YEAR PASSED WITH TWO OF THE GOVERNMENT’S MORE POWERFUL REGULATORS ESSENTIALLY WAITING FOR THE BANK TO FILE REAMS OF REPETITIVE PAPER WORK ,

WHAT HAS IT COST THE GOVERNMENT IN DUPLICATION, PAPER WORK AND THE INABILITY TO CARRY OUT THEIR OWN ORDERS?

AS USUAL, THE BANK AND ITS AFFILIATE ADMITTED NO BLAH, BLAH ETC.

AND THE MEXICAN CARTELS HAD NO COMMENT.

I. WAY BACK WHICH FEELS LIKE ANCIENT HISTORY—APRIL21, 2010– TWO DEMOCRATIC SENATORS—THEODORE KAUFMAN, WHO WAS APPOINTED TO FILL OUT JOE BIDEN’S DELAWARE SEAT, AND SHERROD BROWN OF OHIO, SPONSORED A SAFE BANKING ACT THAT WOULD PUT TOUGH LIMITS ON THE SIZE OF BANKS.

IT CONTAINED A STRICT LIMIT OF A 10 PERCENT CAP ON ANY BANK HOLDING COMPANY’S SHARE OF U.S. DEPOSITS AND A 6 PERCENT CAP ON LEVERAGE. “WE NEED TO ENSURE THAT IF BANKS GAMBLE,” BROWN SAID, “THEY HAVE THE RESOURCES TO COVER THEIR LOSSES.”

KAUFMAN SAID HE WAS FRUSTRATED BY HIS COLLEAGUES “ TINKERING AROUND THE EDGES OF OUR BROKEN FINANCIAL SYSTEM. “ AS FOR DEALING WITH BANKS TOO BIG TO FAIL, HE CONCLUDED: “ WE NEED TO BREAK UP THESE INSTITUTIONS BEFORE THEY FAIL, NOT STAND BY WITH A PLAN WAITING TO CATCH THEM WHEN THEY DO FAIL.”

THE BILL WAS ESSENTIALLY DEFEATED BECAUSE THE TREASURY UNDER TIM GEITHNER WAS OPPOSED, BLAMING THE CRISIS INSTEAD TO A “ FAILURE OF GOVERNMENT.”

KAUFMAN, HOWEVER, ARGUED THAT “FRAUD AND LAWLESSNESS WERE KEY INGREDIENTS IN THE FINANCIAL COLLAPSE” AND ESPECIALLY FOR “HAVING UNREGULATED DERIVATIVES MARKETS.”

JUMP FORWARD TO EARLY MAY THIS YEAR WHEN SENATOR BROWN AND REPUBLICAN SENATOR DAVID VITTER OF LOUISIANA, –KAUFMAN’S BRIEF TERM EXPIRED AND HE DIDN’T SEEK RE-ELECTION– INTRODUCED ANOTHER BILL TO MAKE BANKS SAFER AND DISALLOW THE USE OF TAXPAYER MONEY TO SAVE FINANCIAL INSTITUTIONS.

THE BILL CALLS FOR THE LARGEST BANKS WITH MORE THAN $500 BILLION IN ASSETS TO HAVE CAPITAL RESERVES OF 15 PERCENT, WHICH IS MUCH HIGHER THAN CURRENT LIMITS. THE BIGGEST BANKS, OF COURSE, ARE JPMORGAN CHASE, CITIGROUP, BANK OF AMERICA, WELLS FARGO, GOLDMAN SACHS AND MORGAN STANLEY.

NEEDLESS TO POINT OUT, THE BANKS ARE ENRAGED ABOUT HAVING TO KEEP MORE OF THEIR FUNDS AS AN INSURANCE POLICY AGAINST ANOTHER FINANCIAL BLOWOUT. AND THEY PROBABLY WILL DILUTE THE LATEST BILL, ASSUMING IT EVER GETS OUT OF CONGRESSIONAL BANKING COMMITTEES, ESPECIALLY THE ONE IN THE GOP HOUSE.

JUST LOOK AT THE DODD –FRANK ACT OF 2010 AND OTHER SO-CALLED STRONGER REGULATORY PROPOSALS WHICH HAVE BEEN LOBBIED TO NEAR DEATH BY THE OVERPOWERING WALL STREET LOBBYISTS. ITS BEEN FOUR YEARS SINCE THE BILLS WERE PASSED BUT THE REGULATIONS HAVE BEEN WATERED DOWN IN A SANDY-HURRICANE STRENGTH-LIKE TSUNAMI OF BANKERS CASH.

2. LET US NOW PRAISE FAMOUS MEN—AGAIN

SENATOR CARL M. LEVIN, D-MICHIGAN, IS LEAVING NEXT YEAR AFTER SERVING SIX TERMS. HE IS 78 AND HAS BEEN IN CONGRESS SINCE 1978.

HE WAS A TAXI DRIVER AND AUTO FACTORY WORKER, GRADUATED FROM SWARTHMORE AND HARVARD AND, AS A DETROIT CITY COUNCIL PRESIDENT, LED SOME OF HIS COLLEAGUES WITH A BULLDOZER TO KNOCK DOWN UNINHABITED HOUSES BECAUSE HE WAS FRUSTRATED WITH HUD’S DELAYS.

AS CHAIRMAN OF THE ARMED SERVICES COMMITTEE, HE HELPED PASS HISTORIC BILLS TO REMOVE NUCLEAR AND CHEMICAL WEAPONS FROM FORMER SOVIET STATES AND LATER EXTENDED TO NON-SOVIET COUNTRIES WHILE ALSO AIMED TO REDUCE THE RUSSIA-US NUCLEAR ARSENALS BY TWO-THIRDS.

HE WAS CRITICAL OF THE AFGHAN WAR ESPECIALLY WHEN “BUSH TOOK HIS EYE OFF THE BALL AND DECIDED TO GO AFTER IRAQ INSTEAD OF AL-QAEDA.” HE AUTHORED THE COMPETITION IN CONTRACTING ACT AND WHISTLE BLOWER PROTECTION ACT AND STOP TAX HAVEN ABUSE ACT.

HIS ACLU RATING WAS 84 PERCENT AND TIME MAGAZINE IN 2006 SAID HE WAS ONE OF THE 10 BEST U.S. SENATORS. AS A STRONG GUN CONTROL ADVOCATE, HE WAS RATED F BY GUN OWNERS OF AMERICA. DESPITE ALL THAT, HE BECAME NATIONALLY RECOGNIZED WHEN HE LEAD THE INITIAL INVESTIGATIONS OF THE WALL STREET FINANCIAL COLLAPSE.

HE BECAME EVEN MORE KNOWN BECAUSE OF HIS TRADEMARK GLASSES HANGING NEAR THE END OF HIS NOSE WHICH PROMPTED JON STEWART TO CALL LEVIN A CROSS BETWEEN A “KINDLY OLD SHOEMAKER” AND “GRANDPA MUNSTER.’

BUT WE WILL MISS SENATOR LEVIN FOR HIS MOST IMPORTANT CONTRIBUTION TO SENATE OVERSIGHT WHEN HE CHAIRED THE SENATE PERMANENT INVESTIGATIONS SUBCOMITTEE FROM 2001 TO 2003 AND 2007 TO THE PRESENT. THE WORK HE DID LEADING THAT COMMITTEE WITH ITS SERIES OF MULTI-HUNDRED PAGE DEVASTING REPORTS ON A HOST OF FINANCIAL OVERSIGHT INVESTIGATIONS LED THE NATIONAL JOURNAL IN FEBRUARY,2012 TO SAY IT WAS “ONE OF THE FEW INSTITUTIONS IN CONGRESS THAT’S STILL WORKING. CARL LEVIN IS A BIG REASON WHY.”

THAT PANEL WAS EMPOWERED TO LOOK AT FEDERAL WASTE, FRAUD AND ABUSE; CORPORATE CRIMES; OFFSHORE BANKING AND TAX PRACTICES; ENERGY MARKETS AND CORRUPTION AND NATIONAL SECURITY.

BUT THE REPORT THAT BROUGHT HIM TO NATIONAL PROMINENCE WAS THE NO-HOLDS-BARRED INVESTIGATION OF WHAT CAUSED THE WORST FINANCIAL DISASTER SINCE THE GREAT DEPRESSION. THE COMMITTEE LAMBASTED BANKS, FEDERAL REGULATORS, CREDIT RATING AGENCIES AND PARTICULARLY GOLDMAN SACHS.

1. THE DETAILS STARTED WITH WASHINGTON MUTUAL AND ASSOCIATED BANKS WHO DECIDED TO RAISE PROFITS BY SELLING HIGH-RISK LOANS WITH FRAUDULENT INFORMATION AND ERRORS TO WALL STREET. THE BANK SOLD 77 BILLION IN TAINTED AND FRAUDULENT SUBPRIME MORTGAGES THAT “POLLUTED THE SYSTEM.” THE BANK’S EVENTUAL COLLAPSE WAS THE LARGEST IN THE HISTORY OF AMERICAN BANKING.

2. THE FEDERAL OFFICE OF THRIFT SUPERVISION, (OTC) ,THE BANKS’ REGULATOR, AND THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE SECONDARY REGULATOR, HAD “FEEBLE OVERSIGHT, WEAK REGULATIONS AND AGENCY INFIGHTING.” OTC “FAILED TO TAKE ENFORCEMENT ACTIONS ON UNSAFE AND UNSOUND LOANS” AND “BLOCKED ACCESS “ TO FDIC SEEING THE RAW DATA. AND FDIC WAS CRITICIZED FOR NOT OVER RIDING OTC AND STARTING “ITS OWN ENFORCEMENT ACTION.”

3. MOODY’S AND STANDARD & POOR, FROM 2004-2007 USED OUTDATED CREDIT MODELS THAT COULD NOT PREDICT PERFORMANCE OF HI-RISK RESIDENTIAL MORTGAGES LIKE SUBPRIME, INTEREST ONLY AND OPTIONAL ADJUSTMENT RATES. THEY WERE UNDER COMPETITIVE PRESSURES FOR MARKET SHARE TO HELP INVESTMENT BANKERS AND PROFIT FROM THEIR BUSINESS. IN 2006, THEY REVISED RATINGS BUT DIDN’T USE THEM TO REEVALUATE THE MORTGAGES. DELAYED THOUSANDS OF DOWNGRADES WHICH MISLEAD INVESTORS.

2004-2008: DESPITE RECORD PROFITS FOR THE TWO AGENCIES, THEY ISSUED UNEXPECTED DOWNGRADES OF MORE THAN ONE-THIRD OF 12,000 MORTGAGES AND COLLATERAL DEBT OBLIGATIONS. THESE ACTIONS “DAMAGED FINANCIAL FIRMS WORLD WIDE AND CONTRIBUTED TO THE FINANCIAL CRISIS” AND “TO MAKE MATTERS WORSE, THE US SECURITIES & EXCHANGE COMMISION IS BARRED BY LAW FROM OVERSIGHT OF SUBSTANCE, PROCEDURES AND METHODLOGIES OF CREDIT RATING MODELS.”

4. GOLDMAN SACHS: FROM 2004-2007, IT RECEIVED LUCRATIVE FEES BY HELPING WASHINGTON MUTUAL AND SUBSIDIARIES TO SECURITIZE HIGH-RISK, POOR QUALITY LOANS “BY OBTAINING FAVORABLE CREDIT RATINGS… AND PUSHING BILLIONS OF RISKY MORTGAGES THRU THE FINANCIAL SYSTEM.”

“THE BANK RESECURITIZED TOXIC MORTGAGES INTO COLLATERIZED DEBT OBLIGATIONS AND USED CREDIT DEFAULT SWAPS AND INDEX TRADING TO PROFIT FROM FAILURES…OF THESE SECURITIES.”

AS DELINQUENCIES INCREASED, THE BANK “SHORTED MORTGAGE SECURITIES UNTIL 2007, CASHED IN LARGE POSITIONS AND BILLIONS IN GAINS.”

“CONFLICTS BETWEEN CLIENTS AND PROPRIETARY TRADING. THE BANK USED SWAPS AND CDS IT DIDN’T OWN TO BET AGAINST MORTGAGE MARKET, GENERATING SUBSTANTIAL REVENUES.”

BY IRWIN BECKER

THIS IS ABOUT A BANK THAT OPERATES IN 80 COUNTRIES, INCLUDING THE USA , HAS BEEN FINED FOR MOST OF THIS CENTURY FOR BREAKING LAWS CONCERNING DRUG CARTELS, MONEY LAUNDERING AND DEALING WITH OTHERS WHO FINANCE TERRORISM, YET HAS AVOIDED THE FATE OF MANY BANK ROBBERS WHO FACE FBI INVESTIGATIONS AND PRISON.

HSBC STARTED IN 1865 AS THE HONG KONG AND SHANGHAI BANKING CORPORATION, FOUNDED BY SIR THOMAS SUTHERLAND IN THE THEN BRITISH COLONY OF HONG KONG.

IN ITS LATEST FILINGS, THE BANK HAS $2.5 TRILLION IN ASSETS, PROFITS OF NEARLY $22 BILLION IN 2011, 89 MILLION CUSTOMERS AND SOME 300,000 WORKERS. THOSE NUMBERS MAKE THE BANK IN THE TOP THREE IN THE WORLD BY ANY FINANCIAL MEASUREMENT.

FEDERAL REGULATORS AND CONGRESS HAVE BEEN INVOLVED IN REVIEWING AND CHARGING THE BANK WITH WORLD CLASS LAW-BREAKING FOR MORE THAN A GENERATION. jUST THIS PAST SUMMER, THE US SENATE SUBCOMMITTEE ON INVESTIGATIONS ISSUED A BLISTERING 333-PAGE INDICTMENT OF THE BANK,S LONG-TERM ILLEGAL ACTIVITIES AND THE ABSENCE OF STRICTER OVERSIGHT AND PUNISHMENT BY THE GOVERNMENT.

AFTER REVIEWING THE EXTENSIVE RECORDS AND UP TO DATE DATA OF THE MALFEASANCE OF THE BANK, THE SENATE COMMITTEE WAS SO FRUSTRATED THAT THE FIRST OF ITS 10 RECOMMENDATIONS FOR IMPROVEMENT WAS “ESSENTIALLY” TO TELL HSBC TO “STOP DOING WHAT YOU ARE DOING, ILLEGALLY OR DANGEROUSLY.”

WHAT FOLLOWS ARE HIGHLIGHTS OF A DECADE OF FLAGRANT MISCONDUCT WHICH THE BANK APPARENTLY KNEW ABOUT BUT WAS EITHER INCOMPETENT OR UNWILLING TO DEAL WITH THE CONSEQUENCES.

BREAKING THE LAWS

1/19/13–ORDERED TO PAY $249 MILLION FOR HOME FORECLOSURE ILLEGALITIES IN THE U.S.

12/12/12–FINED $1.9 BILLION FOR MONEY LAUNDERING IN MEXICO.

7/25/12–FINED $27.5 MILLION FOR MONEY LAUNDERING BY MEXICO!

2010–U.S.OFFICE OF THE COMPTROLLER OF THE CURRENCY (0CC), PART OF THE TREASURY DEPARTMENT, FOUND THE BANK DEFICIENT IN ANTI-MONEY LAUNDERING CONTROLS INVOLVING $60 BILLION IN WIRE TRANSACTIONS WITH 17,000 ACCOUNTS FLAGGED AS POTENTIALLY SUSPICIOUS ACTIONS. THE BANK IS ORDERED STRICTER ANTI-MONEY LAUNDERING PROCEDURES WHICH LED TO “MORE THAN 100,000 TRANSACTIONS NEEDING FURTHER REVIEW. ALTHOUGH THE OCC ORDER COVERED 31 PAGES, NO FINES WERE INCLUDED.

2007-08–THE BANK’S MAJOR AFFILIATE IN MEXICO, HSMX, WAS THE LARGEST SINGLE EXPORTER OF U.S. DOLLARS TO HSBC–$7 BILLION IN CASH OVER TWO YEARS– AN AMOUNT ACCORDING TO REGULATORS THAT COULD ONLY INCLUDE “ILLEGAL DRUG PROCEEDS (AND) HIGH PROFILE CLIENTS INCLUDED IN DRUG TRAFFICKING.”

2001-2007–BANK AFFILIATES IN EUROPE AND MIDDLE EAST HAD OUTLAWED BUSINESS LINKED TO iRAN, WHOSE NAME HAD BEEN STRIPPED FROM THE PAPERWORK. THOSE TRANSACTIONS VIOLATE THE FOREIGN ASSETS CONTROL ACT ADMINISTERED BY THE TREASURY’S OFFICE OF FOREIGN ASSETS CONTROL (0FAC). THAT LAW PREVENTS BANKS AND OTHERS WITH DEALING WITH TERRORISTS, THOSE INVOLVED WITH WEAPONS OF MASS DESTRUCTION, DRUG TRAFFICKING AND ROGUE JURISDICTIONS, I.E., IRAN, NORTH KOREA AND SUDAN.

LAW-BREAKING WITH MEXICO, JAPAN, SAUDI ARABIA AND SOMETHING

CALLED BEARER SHARE ACCOUNTS !

MEXICO

THERE’S SOMETHING ABOUT MEXICO THAT ENTHRALLS HSBC. ITS AFFILIATE HAS 1,100 BRANCHES, $2-BILLION IN ASSETS, 19,000 WORKERS AND 8 MILLION CLIENTS. THE TWO BANKS SOMEHOW GAVE MEXICO ITS LOWEST RATING UNDER THE MONEY LAUNDERING LAW “DESPITE OVERWHELMING INFORMATION THAT MEXICO WAS A HIGH RISK JURISDICTION FOR DRUG TRAFFICKING AND MONEY LAUNDERING,” ACCORDING TO THE SENATE REPORT. THE REPORT CONTINUED:

“IN MAY, 2009, HBUS SUDDENLY INCREASED ITS RISK FACTOR FOR MEXICO BY THREE NOTCHES, FROM ITS LOWEST TO HIGHEST LEVEL. STILL, IN EFFECT, THE INTERNATIONAL HSBC DID NOT FOLLOW SUIT UNTIL 2012, WHEN IT RAISED ITS RISK RATING FROM CAUTIONARY TO HIGH RISK.”

WHAT MAKES THE LAX ATTITUDE BY THE BANKS DEALING WITH MEXICO SO AMAZING IS CLEARLY AND DEPRESSINGLY OBVIOUS IN A SPECTACULAR COLUMN PRINTED JANUARY 3 IN THE NEW YORK TIMES.

THE COLUMN WAS WRITTEN BY ROBERT MAZUR, A FORMER FEDERAL AGENT WHO ACTED FOR YEARS AS AN UNDERCOVER MONEY LAUNDERER IN MEXICO AND OTHER HEMISPHERIC COUNTRIES. HE WROTE:

“LAST MONTH, HSBC ADMITTED IN COURT PLEADINGS THAT IT HAD ALLOWED BIG MEXICAN AND COLUMBIAN DRUG CARTELS TO LAUNDER $881 MILLION. THE BANK ALSO ADMITTED TO USING VARIOUS SCHEMES TO MOVE HUNDREDS OF MILLION DOLLARS TO NATIONS SUBJECT TO TRADE SANCTIONS INCLUDINGIiRAN, CUBA AND SUDAN IN VIOLATION OF THE TRADING WITH THE ENEMY ACT.”

HSBC ADMITTED TO THE CRIMINAL CONDUCT AND PAID $1.9 BILLION IN FINES AND FORFEITURES WHICH OCCURED OVER A FIVE-YEAR PERIOD. THE PAYMENT, MAZUR ESTIMATED, WAS “ROUGHLY 10 PERCENT OF THE PRE-TAX PROFITS (THE BANK) EARNED) JUST IN 2010,” WHICH WAS “ONE OF THE MORE THAN FIVE YEARS DURING WHICH (THE BANK) ADMITTED TO CRIMINAL CONDUCT.”

IN AN EDITORIAL ON 12/12/12, WHEN THE HSBC SETTLEMENT WAS ANNOUNCED, THE TIMES, WITH THE HEADLINE “TOO BIG TO INDICT” SAID “CLEARLY THE GOVERNMENT HAS BOUGHT INTO THE NOTION OF TOO BIG TO FAIL IS TOO BIG TO JAIL.” THE EDITORIAL CONTINUED:

“BUT EVEN LARGE FINANCIAL SETTLEMENTS ARE SMALL COMPARED WITH THE SIZE OF INTERNATIONAL MAJOR BANKS. MORE IMPORTANT, ONCE CRIMINAL SANCTIONS ARE CONSIDERED OFF LIMITS, PENALTIES AND FORFEITURES BECOME JUST ANOTHER COST OF DOING BUSINESS, A RISK FACTOR TO CONSIDER ON THE ROAD TO PROFITS. THE SOLUTION IS TO REDUCE THE (BANKS ) SIZE BY BREAKING THEM UP AND RESTRICTING THEIR ACTIVITIES, NOT SHIELD THEM AND THEIR LEADERS FROM PROSECUTION FOR ILEGAL ACTIVITIES.”

JAPAN

THE CASE OF THE SUSPICIOUS TRAVELER’S CHEQUES. FROM 2005-2008, HOKURIKO, A REGIONAL JAPANESE BANK, SENT $290 MILLION TO HBUS IN THE FORM OF TRAVELER’S CHEQUES, SOMETIMES $500,000 IN U.S. MONEY PER DAY. THE DENOMINATIONS WERE USUALLY $500 TO$1,000 IN LARGE BLOCKS ,SEQUENTIALLY NUMBERED “AND SIGNED AND COUNTER SIGNED WITH THE SAME ILLEGIBLE SIGNATURE,” ACCORDING TO THE SENATE REPORT.

THE BANK REFUSED TO GIVE ANY INFORMATION ON THE SOURCES AND NAMES OF THE ENDORSERS. THE AMERICAN BANK EVENTUALLY LEARNED THE CHEQUES WERE PURCHASED BY RUSSIANS FROM A RUSSIAN BANK IN A COUNTRY THAT UNITED STATES CONSIDERS AT HIGH RISK FOR MONEY LAUNDERING.

THE JAPANESE BANK HAD NO IDEA WHY UP TO $500,000 IN RUSSIAN CHEQUES WERE DEPOSITED DAILY INTO ONE OF THIRTY DIFFERENT ACCOUNTS OF PERSONS AND CORPORATIONS SUPPOSEDLY IN THE USED CAR BUSINESS. (HEY, THIS STUFF COULD HAVE BEEN SOLVED BY A SLEEP-DEPRIVED TEEN WITH A COMPUTER.) THE SENATE INVESTIGATION CONCLUDED THAT THIS TYPE OF MONEY LAUNDERING IS STANDARD OPERATING PROCEDURE FOR DRUG TRAFFICKERS AND OTHER CRIMINALS. NO CONCLUSIVE ANSWER WAS REACHED ABOUT WHICH ORGANIZED CRIMINAL GROUP USED THIS DIRTY -TO- CLEAN MONEY SCHEME.

BUT OUR GOVERNMENT REGULATORS SAID OUR FAVORITE BANK WAS AGAIN CITED REGULARLY FOR NOT HAVING SUFFICIENT STAFF TRAINED TO LOOK FOR OBVIOUS “SUSPICIOUS” TRADES. (SEE HSUS AND AFFILIATES IN MEXICO) AND THE HIGH NUMBER OF SERIOUS INFRACTIONS ALMOST “NEVER” RESULTED IN FINES, THE SENATE REPORT SAID, ADDING:

“CRITICISMS WERE SEVERE, WIDE SPREAD AND LONG STANDING WITH ANTI-MONEY LAUNDERING DEFICIENCIES. WHY WERE PROBLEMS ALLOWED TO ACCMULATE AND WHY THE OCC HAD NOT COMPELLED CORRECTIVE ACTION EARLIER ?”

BEARER SHARE ACCOUNTS–FLORIDA CASE

THESE ODD-SOUNDING AND RARELY USED FINANCIAL DOCUMENTS, SOME 2,000 IN A DECADE INVOLVING THE BANK, ARE “A NOTORIOUS TYPE OF CORPORATION THAT INVITES SECRECY AND WRONG-DOING BY ASSIGNING OWNERSHIP TO WHOMEVER HAS PHYSICAL POSSESSION OF THE SHARES,” THE SENATE STUDY SAID. THIS IS WHAT HSBC DID WITH SUCH ACCOUNTS WITH A MIAMI-BASED OPERATION.

THE CLIENTS SHOWED $2.6 BILLION IN ASSETS WHICH, OVER A PERIOD OF TIME, LED TO $26 MILLION IN BANK FEES. AFTER AUDITORS LOOKED MORE CLOSELY AT THE BOOKS, THEY SAID THERE WERE HIGH RISKS AND TOLD THE BANK EITHER TAKE PHYSICAL CUSTODY OF THE SHARES OR REQUIRE THE RELATED CORPORATIONS TO REGISTER NAMES OF SHAREHOLDERS.

THE BANK RESISTED THE POSSIBLITY OF STANDARD ENFORCEMENT ACTION, ACCORDING TO THE SUMMARY IN THE sENATE REPORT.

AS A RESULT, TWO MIAMI HOTEL DEVELOPERS–FATHER AND SON–USED THE QUESTIONABLE ACCOUNTS TO OPEN A FINANCE COMPANY AND A TIME-SHARING SHIPPING COMPANY TO HIDE $150 MILLION IN ASSETS AND $49 MILLION IN INCOME.

IN 2010, THE OWNERS WERE CONVICTED OF TAX FRAUD AND FILING FALSE RETURNS. THEY WERE EACH GIVEN 10 YEARS IN PRISON AND ORDERED TO PAY BACK TAXES, INTEREST AND PENALTIES OF $17 MILLION. IT WAS NOT CLEAR WHETHER THE FINES WERE EVER PAID.

DID THE LARGEST PRIVATE SAUDI BANK FINANCE AL QAEDA?

HSBC HAS BEEN REPEATEDLY WARNED BY FEDERAL REGULATORS OF THE HIGH RISKS OF FINANCING TERRORISM WHEN DEALING WITH CERTAIN FINANCIAL INSTITUTIONS IN THE MIDDLE EAST, ASIA AND AFRICA.

SUSPICIANS WERE RAISED ABOUT AL RAJHI BANK, THE LARGEST BANK IN SAUDI ARABIA WHICH IS CONTROLLED BY ONE FAMILY WHOSE LEADING FOUNDER IS SULAIMAN BIN ADDULAZIZ AL RAJHI. AFTER 9/11, ACCORDING TO THE SENATE REPORT, HIS NAME WAS LINKED TO WHAT OSAMA BIN LADEN CALLED HIS “GOLDEN CHAIN.” A LIST OF FINANCIAL SUPPORTERS WHOSE NAMES WERE OBTAINED IN MARCH 2002 WHEN THE BOSNIAN OFFICES OF THE BENEVOENCE INTERNATIONAL FOUNDATION , A SAUDI NON-PROFIT DESIGNATED AS A TERRORIST GROUP, WAS BROKEN INTO AND HUNDREDS OF COMPUTER FILES WERE TAKEN.

ONE FILE’S DOCUMENTS INCLUDED A WRITTEN LIST OF 20 INDIVIDUALS IDENTIFIED AS FINANCIAL CONTRIBUTORS TO BIN LADEN WHO REPLACED EARLIER FINANCING THAT WAS LOST AFTER THE AL-QAEDA’S LEADER’S “ABRUPT DEPARTURE FROM SUDAN IN 1996” AND THE ESTABLISHMENT OF A NEW BASE IN AFGHANISTAN, THE REPORT SAID.

ONE OF THE HAND-WRITTEN NAMES ON THE LIST WAS THE AFORE MENTIONED SULAIMAN. THE SENATE REPORT SAID THE BOSNIAN FILE INDICATED THAT THE SAUDI BANK HAD SENT FUNDS TO SOME OF THE 9/11 HIJACKERS STATIONED IN GERMANY.

IN 2005, HSBC INTERNALLY TOLD “ITS AFFILIATES SHOULD SEVER TIES WITH THE RAJHI BANK BUT THEN REVERSED ITSELF FOUR MONTHS LATER, LEAVING THAT DECISION UP TO AFFILIATED BANKS DOING BUSINESS IN THE MIDDLE EAST”, THE REPORT SAID. THE AFFILIATES CONTINUED DOING BUSINESS AS BEFORE.

HBUS CLOSED ITS CORRESPONDENT BANKING AND BANK NOTES ACCOUNT WITH THE SAUDI BANK FOR TWO YEARS. BUT IN 2006, THE SAUDI BANK THREATENED TO PULL ALL ITS BUSINESS UNLESS IT REGAINED ACCESS TO THE HBUS NOTES PROGRAM. AS A RESULT, THE AMERICAN-BASED BANK PROVIDED NEARLY $1BILLION IN NOTES TO THE SAUDI BANK. FINALLY, IN 2010, THE BUSINESS CONNECTION ENDED ON A GLOBAL BASIS WHEN HSBC ENDED THE U.S. BANKS NOTE ACTIVITY.

P.S.: DESPITE YEARS OF SUSPICION THROUGH 2010, NEITHER THE AL RAJHI BANK NOR ITS OWNERS HAVE EVER BEEN CHARGED WITH FINANCING TERRORISM OR PROVIDING OTHER MATERIAL SUPPORT.

-30-

P.P.S–I can be reached at ibecker@Cox.Net

IF BANKS ARE TOO BIG TO FAIL

DOES IT MEAN THEY CAN’T GO TO JAIL?

BY IRWIN BECKER

I am starting this blog because there is a growing threat from mutli-national banks to corrupt, if not destroy, the international economy by unregulated greed, arrogant rule-breaking, and more ominously, dealing with drug traffikers, terrorists and other illegal money crimes that would put any other less powerful entity either out of business or its leaders into jail.

Think Mafia, only wealthier, above the laws, unafraid of tepid government regulations, including most of the so-called protections that were adopted after 9/11.

I will list some of the more egregious felonies carried out in 2012, which in later blogs I will provide copious details and what we should do to overcome these corporate “banksters,” as one financial columnist suggested.

And as you will see from the list, the “banksters” club also contains non-financial corporations.

1. Hong Kong & Shanghai Banking Corp. (HSBC), practically the largest and most profitable bank in the world. Fined $1.9 billion for violating the Bank Security Act and Trading with the Enemy Act which involved handling billions in suspected Mexican drug money transactions and aiding banks in Iran, Saudi Arabia and Libya, and other banks in south Asia, linked to financing terrorism.

Even more absurd, Mexico”s chief bank regulator fined HSBC $27.5 million in a money laundering probe. By the way, it took a Senate investigating committee 333 pages, including footnotes, to list HSBC’s lengthy and repeated violations. That will be my next detailed blog.

2. The LIBOR rate-fixing scandal, sort of the Watergate of international banking. The London Interbank Offered Rate is used by the international banks to set interest rates that impact mortgages, credit cards and student loans. The banks colluded to work out rates that benefited their operations, especially in the trillion-dollar markets of selling and buying financial instruments.It is expected that most of the largest banks in the world are involved. Fines have so far been assessed against:3.Barclays Bank of England–$450 million.

4.UBS of Switzerland’s Japanese subsidy–expected to reach to

one billion.

5.HSBC (world HQ in England)–Has set aside up to $1.5 billion to cover expected fines in the LIBOR scandal.

6. Standard Chartered of England. Fined $322 million for blanking out names of clients in transactions with Iran and Sudan to avoid disclosures. Those transactions are illegal under several international laws.

7.Deutsche Bank of Germany. Fined $202 million when a subsidiary used false information to get Federal mortgage insurance.

8.ING Bank (Dutch) has set aside $1.5 billion in a money laundering violation of sanctions against Iran, Libya and others.

9.Bank of America is being sued for $1 billion by the government for a multi-year scheme by the former Countrywide unit called “the hustle” to sell thousands of fraudulent and defective mortgages to Fannie Mae and Freddie Mac, thereby costing taxpayers $1 billion in bailout losses.

Why should banks have all the fun. Here are other corporate giants recently caught in the act.

10.The European Competition Commission (some critics pronounce it ECH!) because it has no criminal prosecution powers, did slam a pile of mega fines in a price-fixing scheme involving six major international corporations who fixed prices for picture and display tubes for TVs and computers over several years. The culprits:

11.Royal Philips Electronics. 11/12:Royal Philips again with LG Electronics

13.Panasonic. 14.Samsung. 15. Toshiba. 16. Technicolor. Keep them in mind on your next electronics purchases. Rebates anyone?

Our government recently announced a multi-billion agreement, aided by many states attorneys general, with four American financial institutions to try to make up for the overwhelming illegal activities leading to the highest rate in housing foreclosures since the last real depression (what was so “great” about that fiasco?)

17-20. Ally Financial, CitiGroup, JPMorganChase and Wells Fargo are to pay $5 billion in cash plus $1.5 billion to borrowers in foreclosure, or $!,500-$2000 each. Another $20 billion to cut loan balances and refinance borrowers who are current but owe more than their homes are worth.

The four banks were chosen for their extensive illegal activities and because this off-law quartet handles 55% of outstanding home loans and 27 million mortgages in the country.

The agreement said that since 1210 the banks had serially submitted bogus mortgage documents to repossess homes. Other commentators have noted that since the market crash home prices have dropped 33 percent, real estate values have fallen by $7 trillion, leaving 11 million home owners with mortgages exceeding property values by $750 billion.

21. Amgen (biotechnology giant) plead guilty to illegally marketing its drugs, especially Aranesp and Epogen, which treat anemia. Amgen has already set aside $762 million to settle state and federal charges and 10 whistle-blower suits. In regulatory filings Amgen said the settlement would not disqualify it from still participating in Medicare and other federal programs, according to the NYK Times. A chutzpah award just in time for the holidays. Amgen agreed to pay $136 million in criminal fines, forfeit $14 million, with $612 million to settle civil cases. Aranesp was Amgen’s biggest product, bringing in $4 billion a year. But later studies questioned the drug’s effectiveness, with the drug bringing in only $1.55 billion in the first nine months of 2012.

22. GlaxoSmithKline earlier in the year was fined $3 billion in part for promoting anti depressants and other drugs for unapproved uses.

23-And finally, in what looks like a sure-fire Pulitzer for the NYK Times. In a devastating article on 12/18/12 that ran a unprecedented four pages, it showed Wal-Mart using extensive bribes to build one of its major outlets on land that Mexico was supposed to keep free of commercial development due to its proximity to ancient pyramids that are considered one of the glories of early Mexican history.

I remember when the Times broke the story in April in which Wal-Mart said it had stopped its investigation of bribery in Mexico in 2006. The company c has said since then that it is investigating reports of bribery in other parts of the world.

I end this piece, and my first listing of the most wanted, by quoting a lengthy paragraph that, for the Times, is unusually accusative and written in a style that might have come out of one of Hunter Thompson’s acerbic assaults on American corporate culture:

“The Times’s examination reveals that Wal-Mart de Mexico was not the reluctant victim of a corrupt culture that insisted on bribes as the cost of doing business. Nor did it pay bribes merely to speed up routine approvals. Rather, Wal-Mart de Mexico was an aggressive and creative corrupter, offering large payoffs to get what the law otherwise prohibited. It used bribes to subvert democratic governance–public votes, open debates, transparent procedures. It used bribes to circumvent regulatory safeguards that protect Mexican citizens from unsafe construction. It used bribes to outflank rivals.”

I’ll continue this exploration early next year. I’d like to hear from folks who are immersed in what looks like a growing movement that goes beyond the Occupancy and treats these issues as the next extension of the popular uprising that culminated in substantial legislation before World War I.

I don’t mind using the internet and its access but I am at still a neo-luddite who is troubled by the senseless amount of time people seem not only enamored of but mesmerized every minute of their lives by these little machines. Alas George Orwell.